Global steel production update: China’s property crisis and production slowdown cause China’s worst steel output decline in 3 years, after years of sharp growth

US crude steel production fell further. Nucor Steel moved up to number 15 globally. US Steel, #24, is acquired by #4, Nippon Steel.

By Wolf Richter for WOLF STREET.

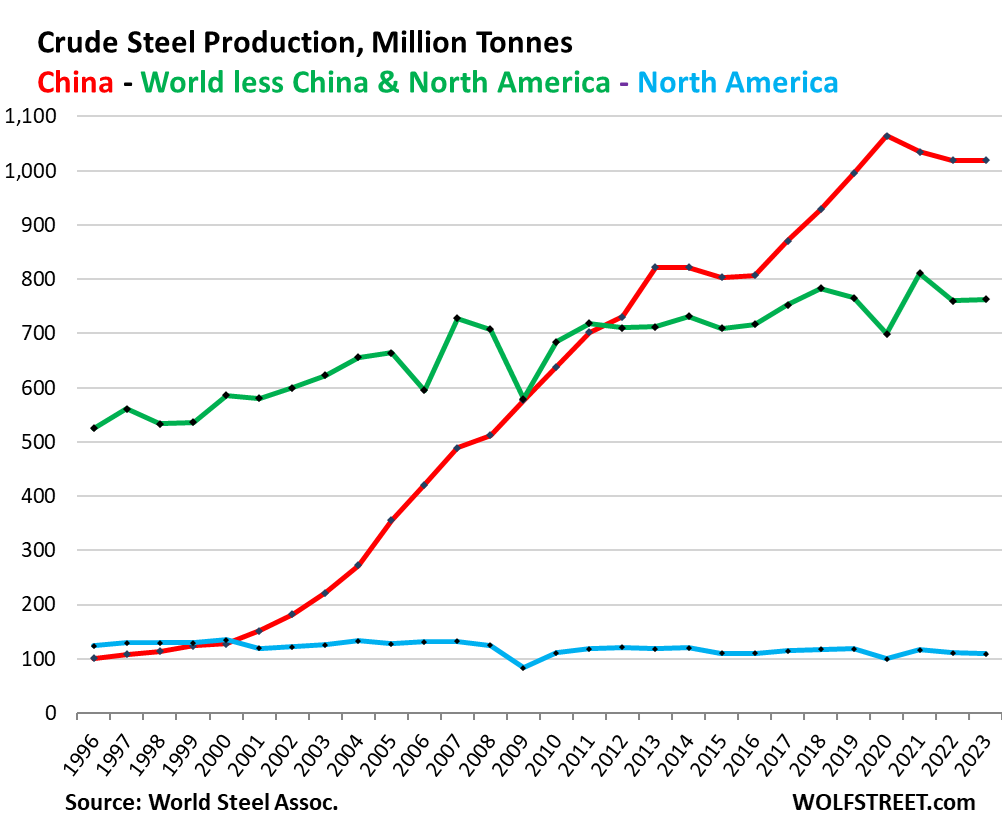

China, which produces over half of the world’s crude steel – ingots, semi-finished products (bills, blooms, plates) and liquid steel for castings – is dealing with a more or less controlled collapse of its development sector. properties, which was once a major contributor to overall economic growth. Construction is a big user of steel. In addition, there has been a slowdown in production.

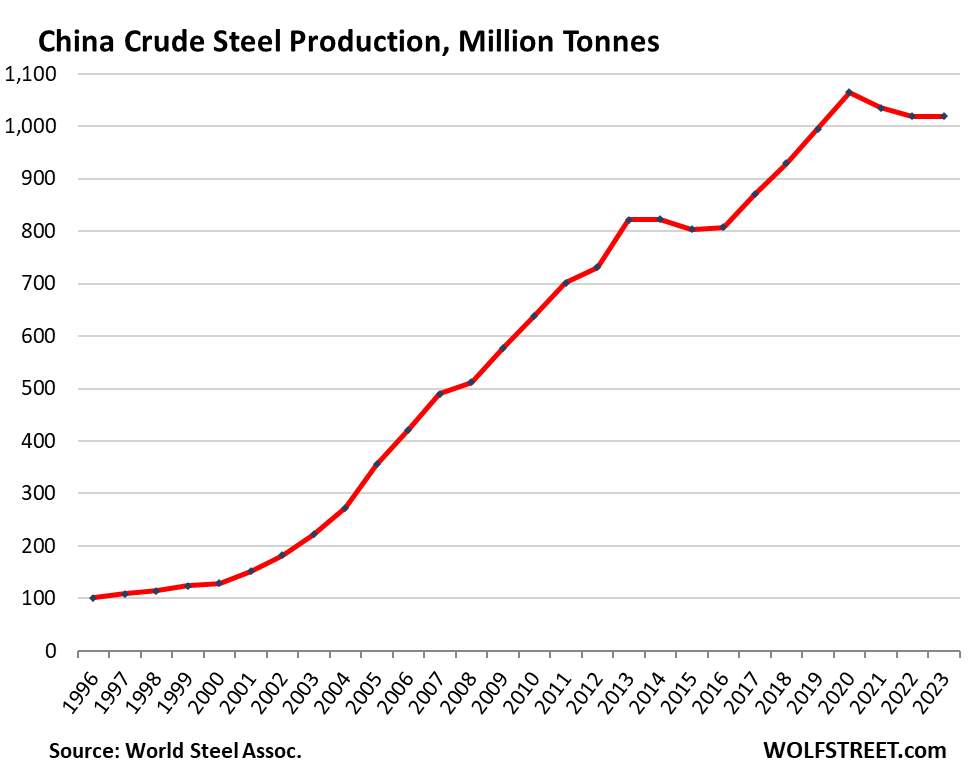

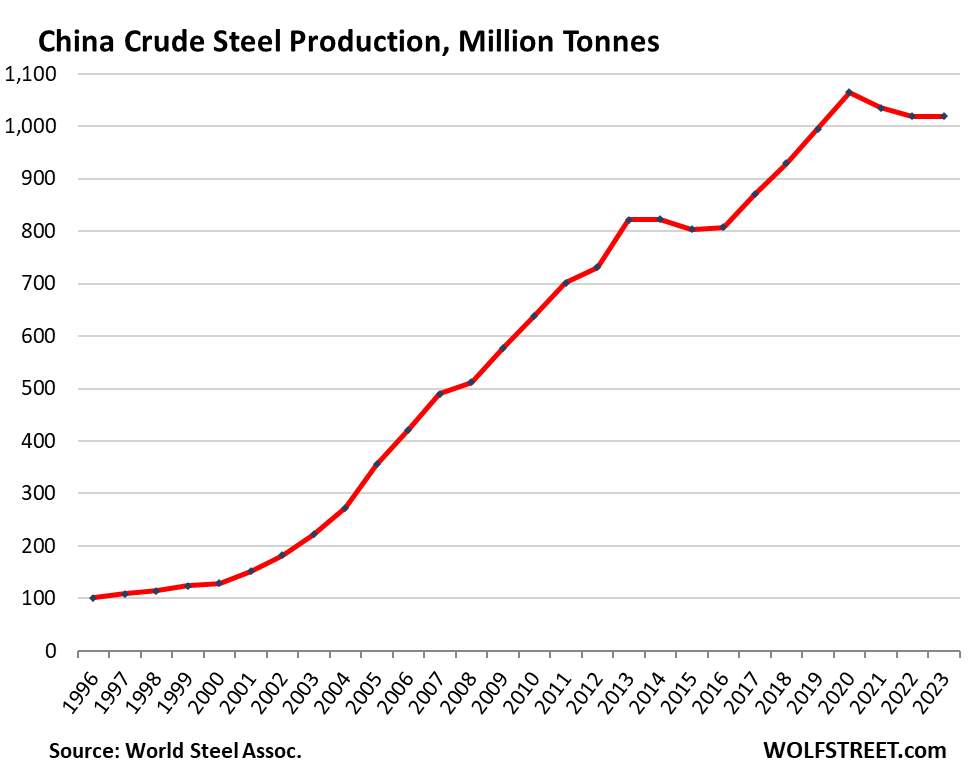

So from a peak in 2020, China’s crude steel output has fallen 4.3% to 1.019 million tonnes (Mt) in 2023, according to new data from the World Steel Association, the worst decline in three years of data. until 1996, which was mainly characterized by strong growth rates:

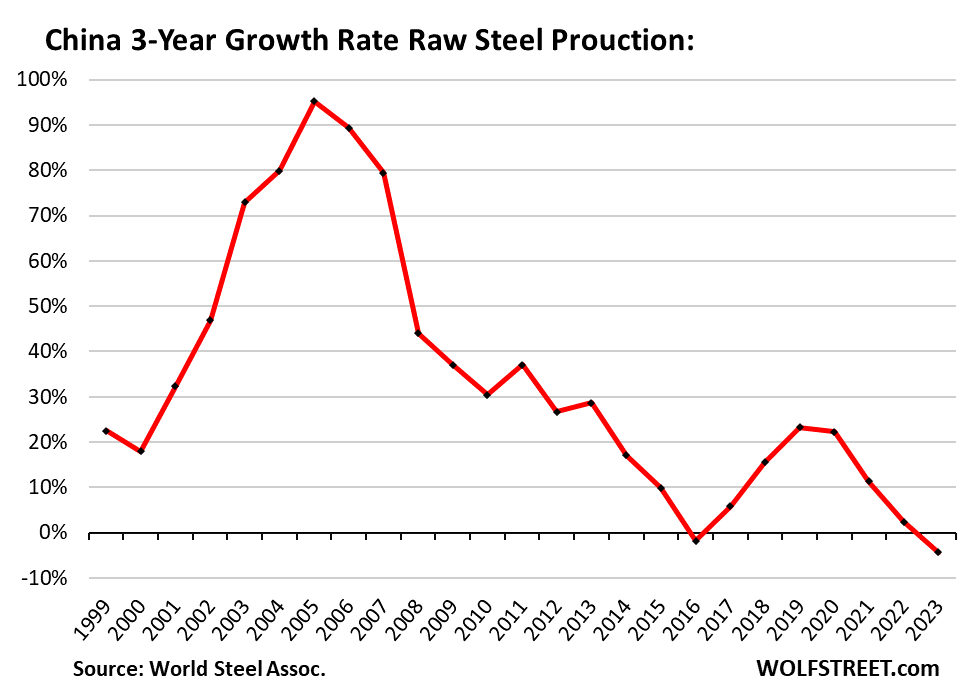

China’s output of crude steel – much of it for use by its domestic manufacturing and construction sectors, rather than exports – had seen strong year-on-year growth rates in most years, even during the global financial crisis. , when steel production in the rest of the world fell sharply. The exception was the period when the government tried to crack down on overproduction from 2014 to 2016. During those three years combined, steel output fell 1.8%, the first-ever decline in data since 1996.

In 2020, the first year of Covid, China’s steel production rose 22% year-on-year as the rest of the world locked down parts of the economy. But then came the declines in 2021 and 2022 in response to the crisis in China’s property development (construction) sector and a slowdown in manufacturing. And in 2023 came a repeat of 2022. From the peak in 2020, China’s steel production fell by 4.3%. The chart shows three-year moving rates of growth:

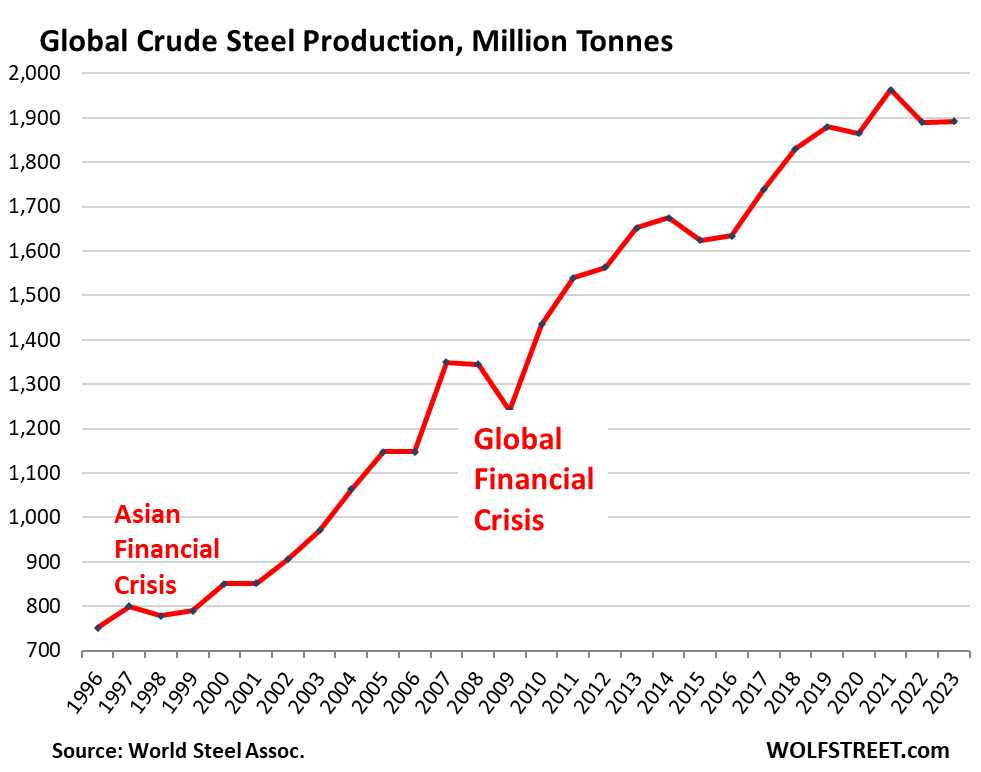

Global production crude steel – despite the situation in China – nevertheless increased in 2023 to 1,892 Mt.

China v. The rest of the world.

Since 2000, global crude steel production has increased by 123%, largely due to a large increase in production in China: During the period, production in…

- China multiplied by 8! (ed)

- North America (USA, Canada, Mexico) down 19% (blue)

- The rest of the world without China and without North America grew by 30% (green).

North American crude steel production declined to 110 Mt, equal to 2015 and 2016, hovering below 1996 levels.

US production, at 81 Mt, was unchanged from 2022 and accounted for 74% of North American production.

In the rest of the world excluding China and North America, steel production in 2023 rose to 763 Mt, after declining last year.

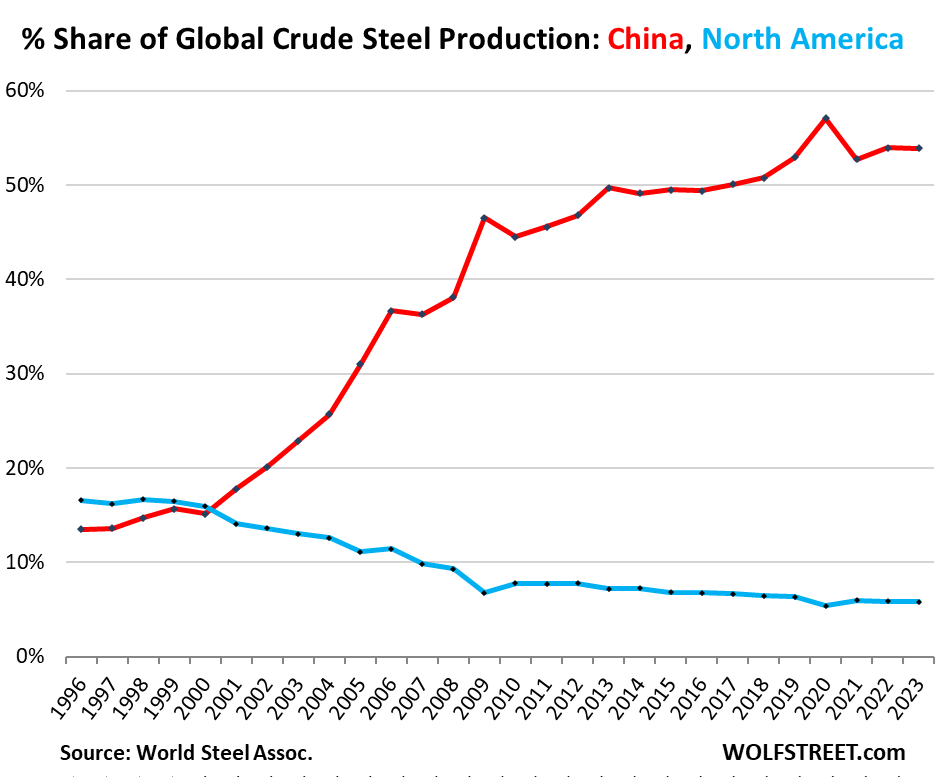

Share of China’s steel production it was 53.9% in 2023, the same as in 2022, but down from 57.1% at the peak in 2020.

The North American share has been in a long steady decline and in 2023 fell to 5.8%, the second lowest ever, behind only 2020.

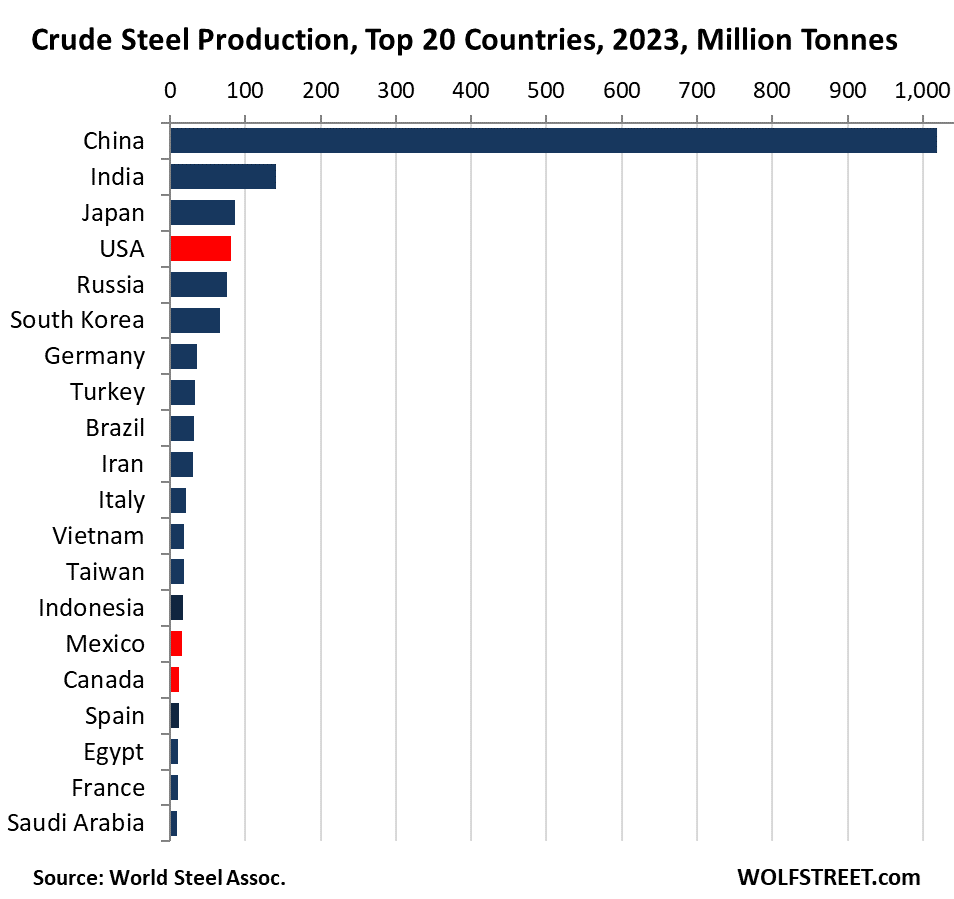

Top 20 countries in crude steel production.

China’s production (1,019 Mt, #1 in the world) was seven times that of India (141 Mt, #2 in the world). India’s production has increased by 40% since 2017. The US is #4, with 1/12th of China’s production (North American countries in red):

Top 20 steel producing companies.

The largest US steelmaker, Nucor, moved up to #15 globally in 2023, from #16 in 2022. The next two steelmakers, Cleveland-Cliffs and US Steel, are #22 and #24 globally. US Steel is in the process of being acquired by Nippon Steel, #4 globally. The acquisition could push Nippon Steel into the No. 3 slot.

Eleven of the top 20 are Chinese companies. The number 2 producer, ArcelorMittal, a product of India’s Mittal Steel which has acquired French company Arcelor, is registered in Luxembourg and run from India.

| Top 20 steel producing companies | Mt | ||

| 1 | China Baowu Group | China | 130.8 |

| 2 | ArcelorMittal, includes 60% AM/NS India | Luxembourg, India | 68.5 |

| 3 | Ansteel Group, incl. Benxi | China | 55.9 |

| 4 | Nippon Steel Corporation | Japan | 43.7 |

| 5 | The HBIS group | China | 41.3 |

| 6 | Shagang group | China | 40.5 |

| 7 | POSCO Holdings | South Korea | 38.4 |

| 8 | Jianlong Group | China | 37.0 |

| 9 | Shougang Group | China | 33.6 |

| 10 | Tata Steel | Indian | 29.5 |

| 11 | Delong Steel | China | 28.3 |

| 12 | JSW Steel Limited | Indian | 26.2 |

| 13 | JFE Steel Corporation | Japan | 25.1 |

| 14 | Hunan Steel Group | China | 24.8 |

| 15 | Nucor Corporation | US | 21.2 |

| 16 | Steel blade | China | 19.6 |

| 17 | Shandong Steel Group | China | 19.5 |

| 18 | Hyundai Steel | South Korea | 19.2 |

| 19 | Steel Authority of India Limited (SAIL) | Indian | 19.2 |

| 20 | Rizhao Steel | China | 18.7 |

| 22 | Cleveland Cliffs | US | 17.3 |

| 24 | American Steel | US | 15.8 |

Do you like reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug of beer and iced tea to find out how:

Want to be notified by email when WOLF STREET publishes a new article? Register here.

![]()

#Global #steel #production #update #Chinas #property #crisis #production #slowdown #Chinas #worst #steel #output #decline #years #years #sharp #growth

Image Source : wolfstreet.com